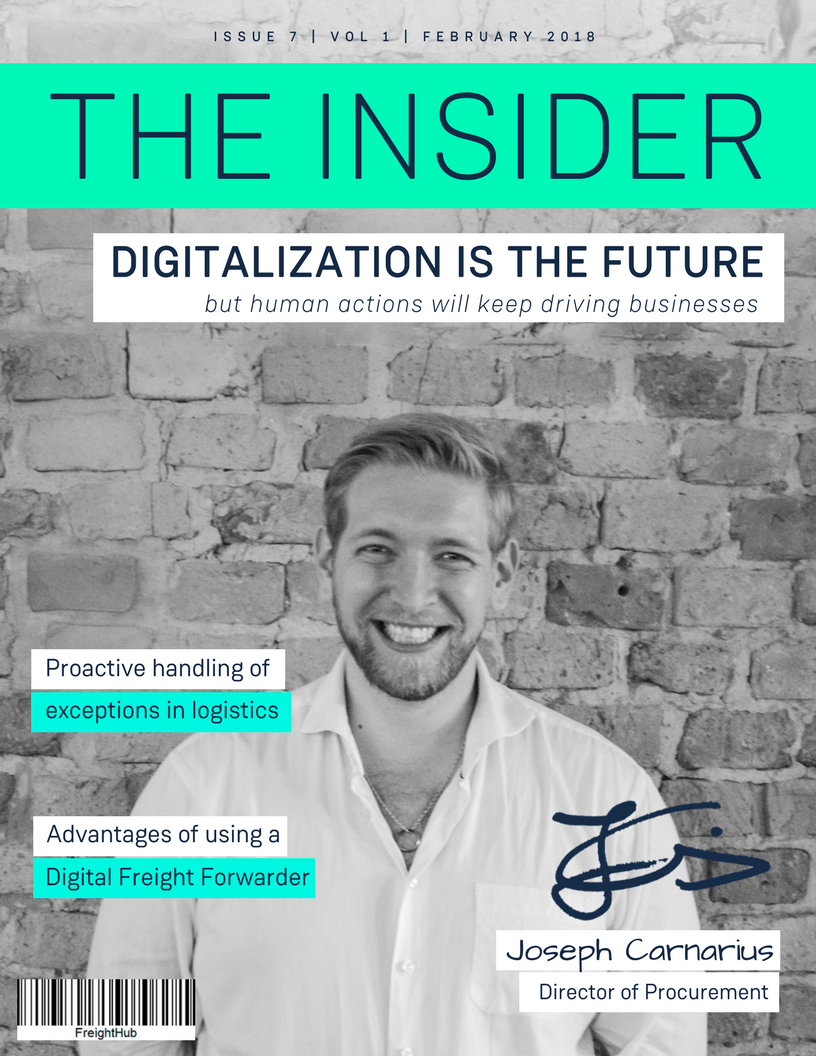

Recently promoted to Director of Procurement for FreightHub, Joseph Carnarius, has been involved in a number of strategic ventures over the past several years. A graduate of the prestigious WHU – Otto Beisheim School of Management, Joseph joined FreightHub in 2016 as Project Leader for Business Development.

We caught up with Joseph to ask him about the supply chain market, FreightHub and why, in particular, logistics.

Let’s begin with Logistics. Why? What’s the fascination?

JC – Put simply, logistics moves the world. It is extremely complex. Look around your desk. Everything has been touched by logistics not once but multiple times. How it all has kept running based on just human interaction with little automation for all these years is amazing.

In the recent past, technology has opened many opportunities for shippers and providers to work together – the result can be improved time in transit, costs, less trouble with unreliable suppliers, e.g., in Asia and thus overall a higher supply chain efficiency. There is so much optimization potential.

When it comes to logistics, what are shippers’ top 3 pain points?

JC – From a market environment perspective, capacity, the ability to identify a ‘good rate’ as it relates to the quality of service vs. price, as well as the ability to check and control all charges that are levied in an invoice by the provider.

From an overall perspective, reliability based on transparency and planning in real-time are of concern. Specifically, reliability of transportation by ensuring capacity availability as well as timely deliveries.

The core issue to be solved is transparency in the flow of information. This can lead to a reduced overall cost of the supply chain by preventing micro-planning and firefighting. Realistic planning based on true and live, actionable data can further reduce the cost of the supply chain by avoiding switches to expensive modes of transport such as airfreight. In fact, I see costs through a lack of realistic planning and intransparent processes – not necessarily price – as a 4th pain point for shippers.

Despite the advancement of automation and digitalization, are personal relationships still vital in the supply chain and logistics Industry?

JC – Yes, strong relationships in the supply chain and logistics industry are still very much important. A good one will get things done. For example, shippers may get preference in terms of pricing or first to board for shipments. However, relationships need to be a mix of human to human interaction and system reliability. If you deliver what you promise, this goes a long way. It’s about trust.

Interesting to note is that according to the 22nd annual 3PL report, 92% of shippers note their relationships with 3PLs are successful. In addition, 71% of those shippers that use 3PLs agree that 3PLs contribute to lowering logistics costs.

Why do shippers change providers?

JC – Shippers will change providers when they can see the advantage. Going back to shippers’ pain points, shippers may see an advantage in total cost of the supply chain, reliability, transparency, and real-time planning.

In addition, technology capabilities are playing a bigger role when in deciding what supply chain providers to use. Just slightly more than half of the shippers surveyed in the 3PL report indicated they were satisfied with technology their 3PL offered. This is down from 65% the previous year. This could be because shipper expectations have increased as technology has improved or because shippers are seeking enhanced analytical capabilities to help drive more effective supply chain decisions.

How does digitalization enable control of supply chains?

JC – One of the biggest enablers is the proactive handling of exceptions based on live, actionable data. Digitalization equalizes information and the flow of goods and thus saves costs. It also encourages collaboration among supply chain partners. Based on an AT Kearney study, I recently read, digitalization also has a clear impact on increasing just-in-time sourcing, decentralize inventories and reduce the number of delivery days.

Can you speak more in terms of the benefits of network strength and reliability?

JC – To enable effective flows of information and goods within a network, shippers need asset-owning companies to provide data. Typically, traditional or incumbent freight forwarders have so many partnerships in place that it’s difficult to connect, translate and share the data with customers. Whereas for digital forwarders, technology enables stronger relationships with asset-based carriers.

What are the advantages of using a digital FF? How about an incumbent forwarder?

JC – Right now digital freight forwarders’ systems are not as advanced as traditional forwarders. Traditional forwarders offer a range of services and worldwide coverage. One advantageous example is that traditional freight forwarders still have a slight edge when it comes to shipment handling, however, digital forwarders’ systems for quotation and booking are more advanced. In addition, digital forwarders’ interface is easier to use and utilize. In other words, the user experience tends to be better when using a digital forwarder’s portal. Lastly, shippers achieve more of a cost advantage through automation on the forwarder side which leads to better flows of information and ultimately better control. Digital forwarders can and have become innovation partners to shippers as well as to carriers.

This leads us into our final question for Joseph, why aren’t incumbent forwarders worried about digital providers eating their lunch? Or are they?

JC – Forwarders are feeling pressure from numerous fronts. The Vice-President of Corporate Strategy for Nippon Express described it best in a recent JOC article. “Forwarders are feeling pressure from three sides – the asset-based giants such as UPS and FedEx, from digital startups trying to leverage digital marketplaces and from customers who are pressuring forwarders to extend traditional forwarding services beyond customary delivery destination thresholds such as the installation of medical equipment or the in-home delivery and set up of consumer electronics.” Forwarders need to clearly define who they are.

In terms of digital startups, yes, there is particular concern amongst incumbent forwarders. They are aware of the risks and are trying to come up with their own solutions. They see the potential in improving efficiencies and cost gains and are beginning to invest more in digitalizing processes. There are a number of examples within the industry such as DB Schenker investing in uShip and using it for European road freight and Maersk’s logistics subsidiary DAMCO introducing its own digital forwarding service, Twill.

That’s about it from us, Joseph, is there anything else you’d like to add?

JC – Thanks, yes, FreightHub is a digital asset-free freight forwarding company with the goal to create the best freight forwarding experience for our global customers. To accomplish this we believe there is still quite a bit of human action that drives the business – a lot of deals are still done in informal settings.

Thanks to Joseph for chatting with us today. The forwarding market is rapidly changing. Be sure to stay abreast of the latest news by signing up for FreightHub’s weekly newsletters as well as following the team on social media.